ESG – Beyond the Jargon

May 2023

By Joy Yang, Head of Product Management and Marketing

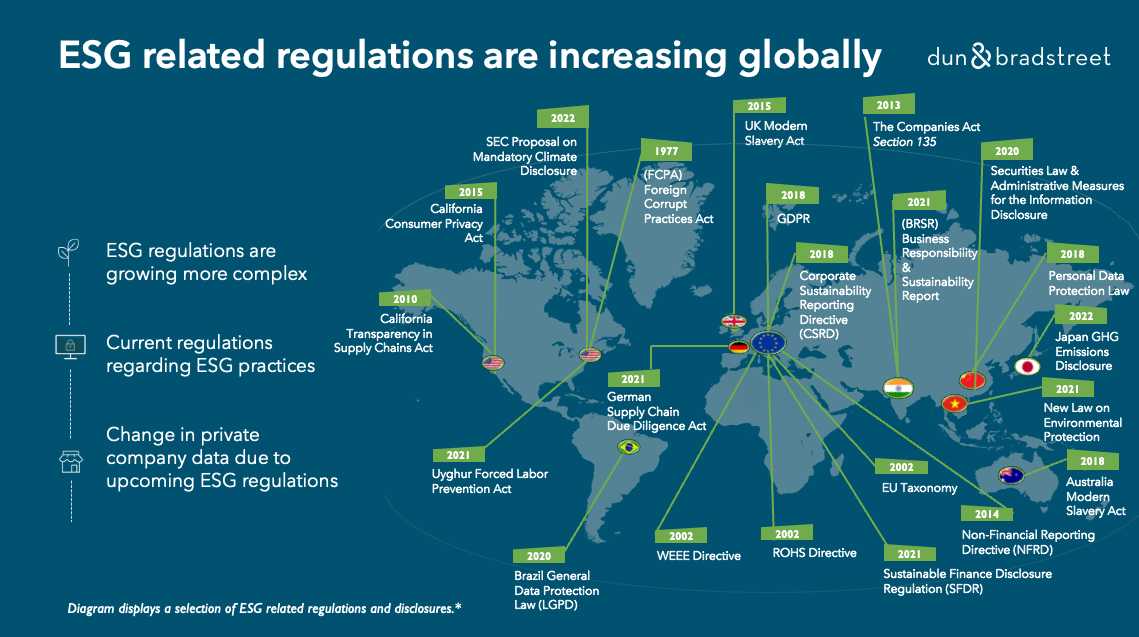

As the regulatory journey for financial Environment, Social, Governance (ESG) product requirements become more and more complicated, so does the language used to describe them

Source: Dun And Bradstreet, Data as of July 19, 2022

Before reaching for the ESG dictionary and guide, investors should start with the basic principles of WHY they are investing in the ESG space. Holding true to core investment principles and goals, such as positive impact allocation, investment risk reduction, performance growth, can be a better approach before applying regulatory requirements. Back fitting your investment goals after fitting into a regulatory framework, can lead to misalignment with your goals and poor execution of a product idea.

At MarketVector Indexes, we start with the investment thesis, and help clients understand if their investment thesis meets an ESG goal. We go beyond the acronyms, to explain concepts and ideas without jargon. Our latest ESG update, provides a look behind indexing the Circular Economy, and how it the index supports sustainability in production of goods, recycling of goods and materials, and water purification and treatment, meeting the UN’s Sustainable Development Goals on Responsible Consumption and Production, and Clean Water and Sanitation.

Watch the latest video here:

For more information on our family of indexes, visit www.marketvector.com.

Get the latest news & insights from MarketVector

Get the newsletterRelated: