Before there is a loud outcry, this quote did not come from me. At the G-10 Rome meetings held in late 1971 secretary of the Treasury John Connally proclaimed to his astonished counterparts, “The dollar is our currency, but it's your problem,” having the intended consequence of driving yet another nail into the coffin of Bretton Woods and leading in short order to a roughly 20% depreciation of the dollar.

I think this quote fits very well in our time today. A strong dollar is generally bad for risk assets, but a dollar that is too strong indicates real financial stress. It is fair to say that the British pound, the EURO and the YEN are trading like an emerging market currency these days, or as they say in crypto twitter: “Trading like a sh..tcoin”. Liability Driven Investment (LDI) almost took U.K. pension funds down and European banks are starting to show cracks in the armor.

Interestingly, crypto assets, first and foremost bitcoin, have seen some decoupling in recent weeks. But there's no hiding the fact that bitcoin in particular has been on a roll lately, looking for a new narrative. If we look at the trading volumes in GBP and EUR, it is noticeable that especially in the last few days extremely much has been traded in Bitcoin. As individuals from the UK and EU see the value of their currency collapsing, they effectively selling the pound and euro for Bitcoin. If this were just a trade to capture the volatility, we would have seen similar spikes in May 2021 and certainly in March 2020. But we didn’t.

Even Hedge Fund legend and Billionaire investor Stanley Druckenmiller who has never had a done year said that crypto could make a comeback as citizens begin to distrust their central banks. He sees this outcome as increasingly possible given the state of the global economy, and the Fed’s uphill battle against both inflation and recession. And it isn’t better on the other side of the Atlantic. When we look at the latest actions of the ECB and BOE, one is overcome by a feeling of helplessness.

Is this just another crypto narrative shift? I think what is exciting about Bitcoin in specifically, is not that it is an inflation hedge or an uncorrelated asset but a non-state control hedge against unstable monetary regimes, wherever those regimes might be. A currency-like asset class that is not controlled by the government is bound to be an important hedge for a growing number of people.

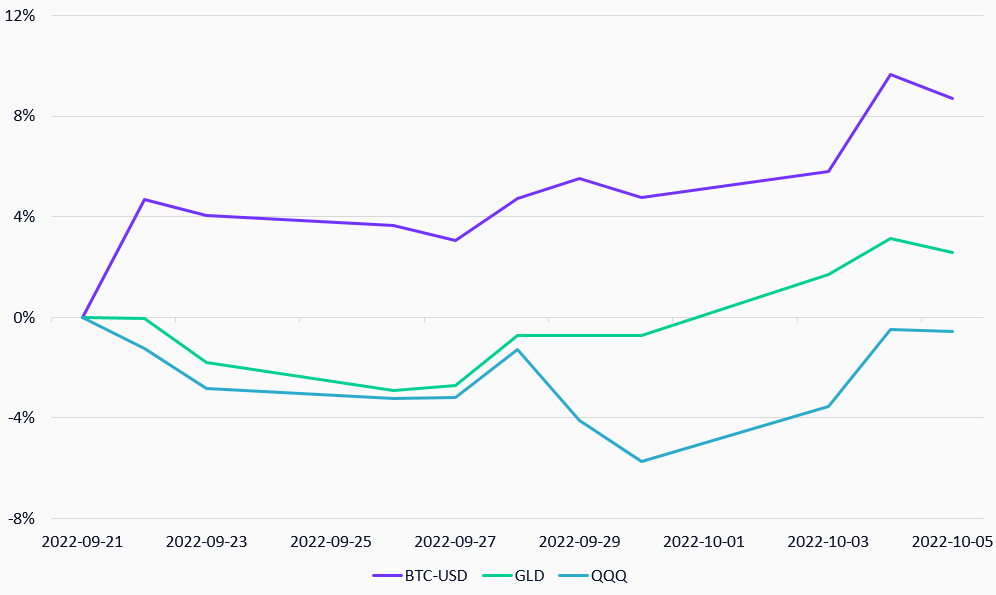

As you can see in Exhibit 1, the same is true of gold, which sees also encouraging signs of life, especially if we compare the recent days with equities such as the Nasdaq.

Cumulative Returns since last FOMC meeting

Source: MarketVector IndexesTM, Yahoo Finance, data as of October 5, 2022

The MVIS® CryptoCompare Bitcoin Index (ticker: MVBTC) measures the performance of a digital assets portfolio which invests in Bitcoin. While it's too early to tell if this is simply seller exhaustion or a new bullish narrative, it does not seem entirely coincidental that digital assets such as Bitcoin have found their footing.

Get the latest news & insights from MarketVector

Get the newsletterRelated: