To many a 50% correction in Cryptocurrencies like the one encountered between 18th and 26th of May may seem extraordinary, especially since one of the factors behind the selling was a tweet from Elon Musk. But given that it has been the best performing asset class on the planet for the last 10 years (816% avg annual return since 2010)1 and low correlation to stocks (.25 )1 it still finds consideration in many investors’ portfolios with higher risk appetites for higher risk adjusted returns.

Quality and selection of Cryptocurrencies are key because, when the market corrects, it potentially shakes out momentum traders and skeptical new entrants, which lead to a higher probability of an outcome where coins with unproven technologies, and low adoption are both likely to see greater outflows and take longer to recover from their previous highs.

In such times, the informed investor may choose to differentiating between so called ‘meme’ coins and coins with strong On-chain metrics like transaction growth, active wallet user growth, and high flows. Triangulating that with Off-chain metrics like developer participation and social media stats can aid the informed investor in the quest to filter out which coins have actual fundamental metrics and are growing both in interest and adoption, regardless of what is going on with their prices.

Conducting research may help the informed investor navigate such corrections by potentially taking advantage of occurring discounts in order to get higher quality exposure to the underlying crypto investment theses: increasing investor adoption, institutionalization, millennial wealth, as well as growing distrust in centralized institutions.

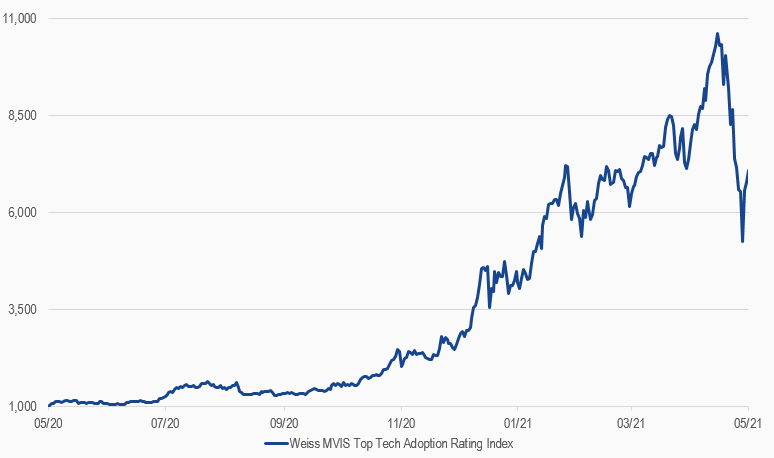

Weiss MVIS Top Tech Adoption Rating Index

26/05/2020-26/05/2021

Source: MV Index Solutions. All values are rebased to 1,000. Data as of 26 May 2021.

Get the latest news & insights from MarketVector

Get the newsletterRelated: