I must admit, I stole this quote from John Burbank, a famous hedge fund manager. What does he mean by that?

If we put our efficient market hypotheses hat on, a price should contain and reflect all relevant information. This sounds intuitive and almost all popular models in finance are based on this assumption. Modern portfolio theory, CAPM, Arbitrage Pricing Theory - just to name a few.

According to Burbank, price is nothing more than the equilibrium of current supply and demand. When something new happens, it takes some time for all the world’s liquidity to appropriately price in the information.

I have to admit, in the crypto world, everything happens a little bit faster. But again, the question is what the true price of a crypto asset is? There’s no consolidated tape nor do we have standard trading pairs. What’s the official closing price for Bitcoin? The simple answer: there’s none! While the cryptocurrency market infrastructure dramatically improved over the years, we find that prices are still strongly influenced by a small number of market events.

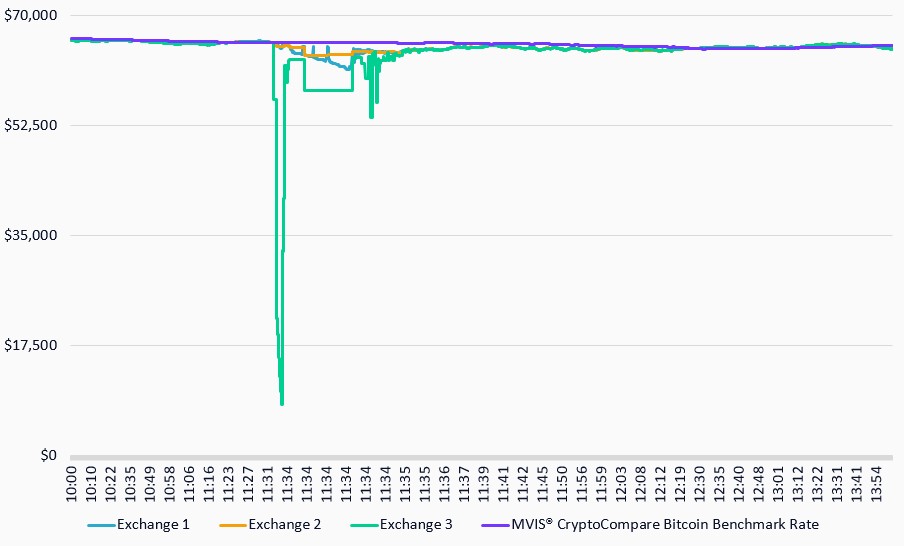

That’s the reason why we put a high weight on reliable price data. The following chart shows you what I mean:

Intraday Comparison of BBR vs.

Large Cryptocurrency Exchanges

Source: CryptoCompare, MarketVector IndexesTM, data as of Oct 21, 2021

On Oct 21, 2021, a flash crash on one large exchange caused Bitcoin’s price to plunge from 66k to 8k and bouncing back to 65k within seconds. This reportedly occurred due to a bug in the trading algorithm of a large institutional investor.

Our Index is a liquidity and time weighted tape. In this example, MVIS® CryptoCompare Bitcoin Benchmark Rate (ticker: BBR) is calculated as an average of 1-hour quantity weighted median prices, which are calculated for twenty 3-minute intervals. As you can see from Exhibit 1, the flash crash from Exchange 3 rippled throughout other Bitcoin markets, demonstrating how an exchange-specific glitch is never an isolated event. However, BBR wasn’t affected at all. A few minutes later, all exchanges traded again in line with the BBR Index.

While we can’t solve the day-to-day market noise (there are plenty of people buying and selling for no economic or fundamental reason at all), we can construct a reliable price to value institutional grade products. Especially if you need to value net asset values or provide pricing data for derivatives, a sound pricing methodology is critical.

This topic is explored in some more detail in an article published in our MVIS Insights of “A Primer: BBR and EBR”.

Get the latest news & insights from MarketVector

Get the newsletterRelated: