It is a known fact, that diversified portfolio of risky assets can offer a higher return for a given degree of risk than those assets could otherwise offer by themselves. Digital Assets, especially Bitcoin, have been the highest returning asset class for eight of the past 10 years. That said, the high volatility of those assets is still a hurdle for many investors. They don’t see fluctuating prices as a feature, but as a bug.

What a lot of people forget is that crypto assets have also been able to deliver higher risk-adjusted returns than other asset classes. Over the past years, digital assets have offered the highest Sharpe ratios when compared to all major asset classes. So investors have been rewarded for this higher absolute volatility. Position sizing can handle this kind of volatility. So you have to consider the crypto volatility in the context of the overall impact on the portfolio. Don’t forget, digital assets have historically had low correlations with other major asset classes, offering a portfolio diversification benefit that has made them attractive to investors.

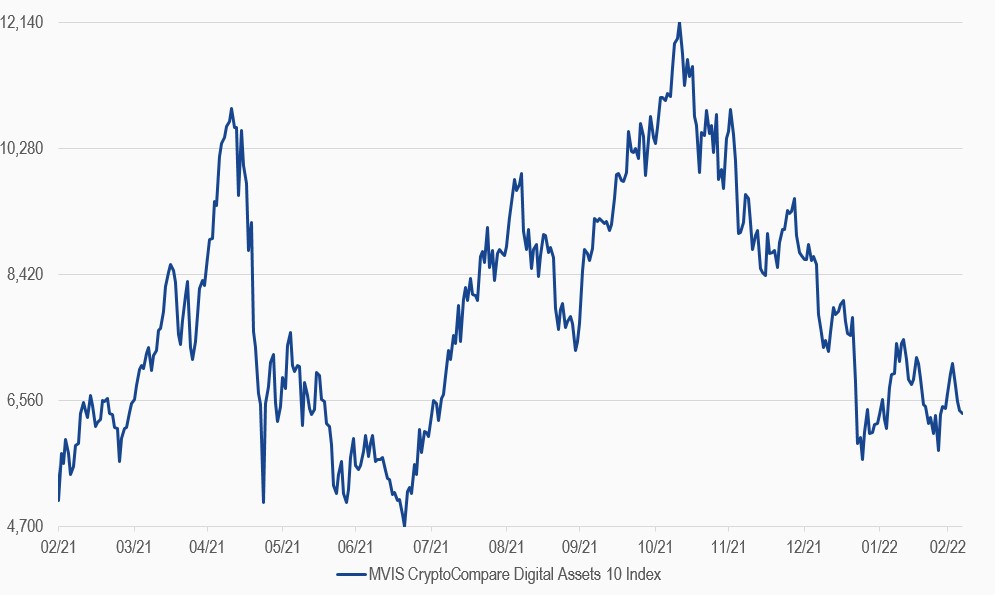

The latest argument against Crypto is the assumption, that Bitcoin can’t reproduce its stellar performance, so it’s not worth investing in it going forward. While it’s true, that Bitcoin probably won’t do 1000x again, the whole crypto market consist of protocols, which are more immature and fulfill different functions and potential demand. An easy way to replace the Bitcoin allocation is investing in a multi coin basket. Let’s analyse the impact of such a strategy via our MVIS CryptoCompare Digital Assets 10 Index (ticker: MVDA10), which is a modified market cap-weighted index tracking the performance of the 10 largest and most liquid digital assets. It’s a simple and robust approach of earning the crypto market return.

Let’s do the test. We add 5% Bitcoin or 5% MVDA10 to the Global Market Portfolio (GMP), which consists of 50% Global equities, 45% global bonds and 5% commodities and do a quarterly rebalancing.

MVIS CryptoCompare Digital Assets 10 Index

28/02/2021-28/02/2022

Source: MV Index Solutions. All values are rebased to 100. Data as of 28 February 2022.

Get the latest news & insights from MarketVector

Get the newsletterRelated: