The Saudi Stock Exchange, or Tadawul, opened its doors to direct investment by foreign institutional investors on June 15.

There has, however, been neither a rapid nor large increase in trading volume. Quite apart from both low oil prices and continuing concerns about stability in the Middle East, prospective participants have had to grapple with difficult legal issues and reams of complex paperwork.

That said, when they do finally arrive, qualified foreign investors will find themselves in a big, liquid and important market for emerging markets investors. Perhaps then, as the exchange’s CEO hopes, their presence will not only enhance research and market sophistication, but also improve corporate governance amongst companies listed on the exchange.

Only time will tell.

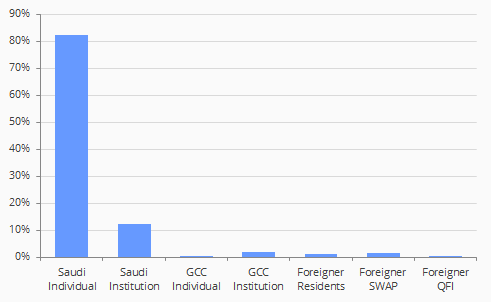

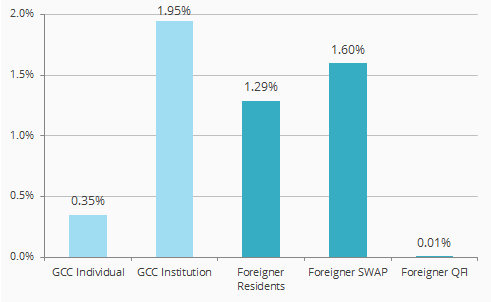

Tadawul Participation: Purchases in July 2015 - % Value (SAR)

Source: Saudi Stock Exchange (Tadawul)

Note: GCC = Gulf Cooperation Council, QFI = Qualified Foreign Investor, and data for July 2015

About the Author:

Thomas Butcher is an independent writer, researcher and consultant focusing, amongst other things, on strategic materials, in particular metals. With 35 years of experience in the financial world, he has lectured and spoken at conferences around the world. Amongst other things, he writes the «Letter from North America» in the Minor Metals Trade Association's bi-monthly publication The Crucible, and was lead author of a chapter in the British Geological Survey's Critical Metals Handbook.

The article above is an opinion of the author and does not necessarily reflect the opinion of MV Index Solutions or its affiliates.