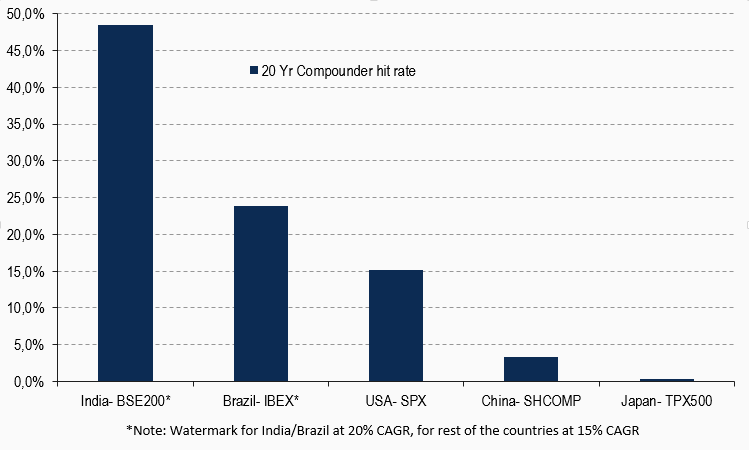

A recent study by Bank of America Merrill Lynch1 proves it: India has some companies with truly stunning performance. (I use that word stunning judiciously.) And this performance proves the triple themes of: go for growth, buy and hold, and invest for the long term.

Of the 180 stocks remaining from today’s S&P BSE2002 index when cyclical stocks (some 20) are stripped out, 101 have been listed for 20 years or more. A signal figure in itself in a rapidly developing economy.

However, it’s the performance amongst these 101 that’s eye-opening: 51 companies (a little over 50%) have, over 20 years, returned a CAGR of at least 20%! And 70% have returned a CAGR of at least 15%.

You only have to compare these figures with similar ones from Brazil, the U.S., China, and Japan, to see there’s really no contest: India wins hands down. And we believe it has only just started.

Proportion of Current Stock Exchange Indices

With 20/15% CAGR Over 20 Years

Source: Bloomberg, Bank of America Merrill Lynch Global Research

Get the latest news & insights from MarketVector

Get the newsletterRelated: